SpaceX flew two significant missions this week. The first was a deployment of Starlink satellites in polar orbit, a first for the Starlink constellation and a topic of some concern within the FAA. The second was the first launch of SpaceX’s rideshare program, Transporter-1, with 143 satellites. SpaceX did confirm that the Starlink satellites on the Transporter-1 launch were the first to have laser inter-satellite relay links.

SpaceX also quietly purchased two oil rigs with the apparent intent of using them as Starship launch/landing platforms. This suggests that the company is hedging against the FAA’s new environmental review of their operations at Boca Chica. Offshore launch and landing were also included in many of SpaceX’s imagery for its point-to-point service.

In the reading political tea leaves department, President Biden announced several appointments within the Office for Science and Technology Policy (OSTP) and specifically elevated OSTP to a Cabinet-level position. The President also appointed MIT Vice President for Research Maria Zuber, a planetary scientist who led efforts to map the surfaces of the moon and Mars, and Nobel chemistry laureate Frances Arnold, a pioneer in synthesizing artificial proteins, to head the President’s Council of Advisors on Science and Technology.

In financial news, Google has, as expected, shutdown Loon, it’s high altitude balloon-based wireless communications division. Few consider this to be an indictment of the general idea and more of a consequence of Google’s internal asset allocation. Within the Chinese commercial space market, launch startup iSpace is preparing for an IPO on the Science and Technology Innovation Board (STAR) exchange. And finally, Redwire continues to acquire smaller mid-market aerospace companies with its acquisition of Oakman Aerospace, a Littleton, Colorado firm known for digital engineering and spacecraft development.

In late-breaking news, Acorn Growth Companies of Oklahoma, a private equity firm with an aerospace and defense fund, announced that former NASA Administrator Jim Bridenstine would be joining the firm as a Senior Advisor. See NASA Administrator Joins Acorn Growth Companies for details.

This week's picks of space sector news compiled from Jeff Foust's FIRST UP newsletter are:

Virgin Orbit's LauncherOne successfully reached orbit Sunday on its second launch.

SpaceX set a record Sunday by launching 143 small satellites on a single Falcon 9

The large number of satellites posed a challenge for space traffic management.

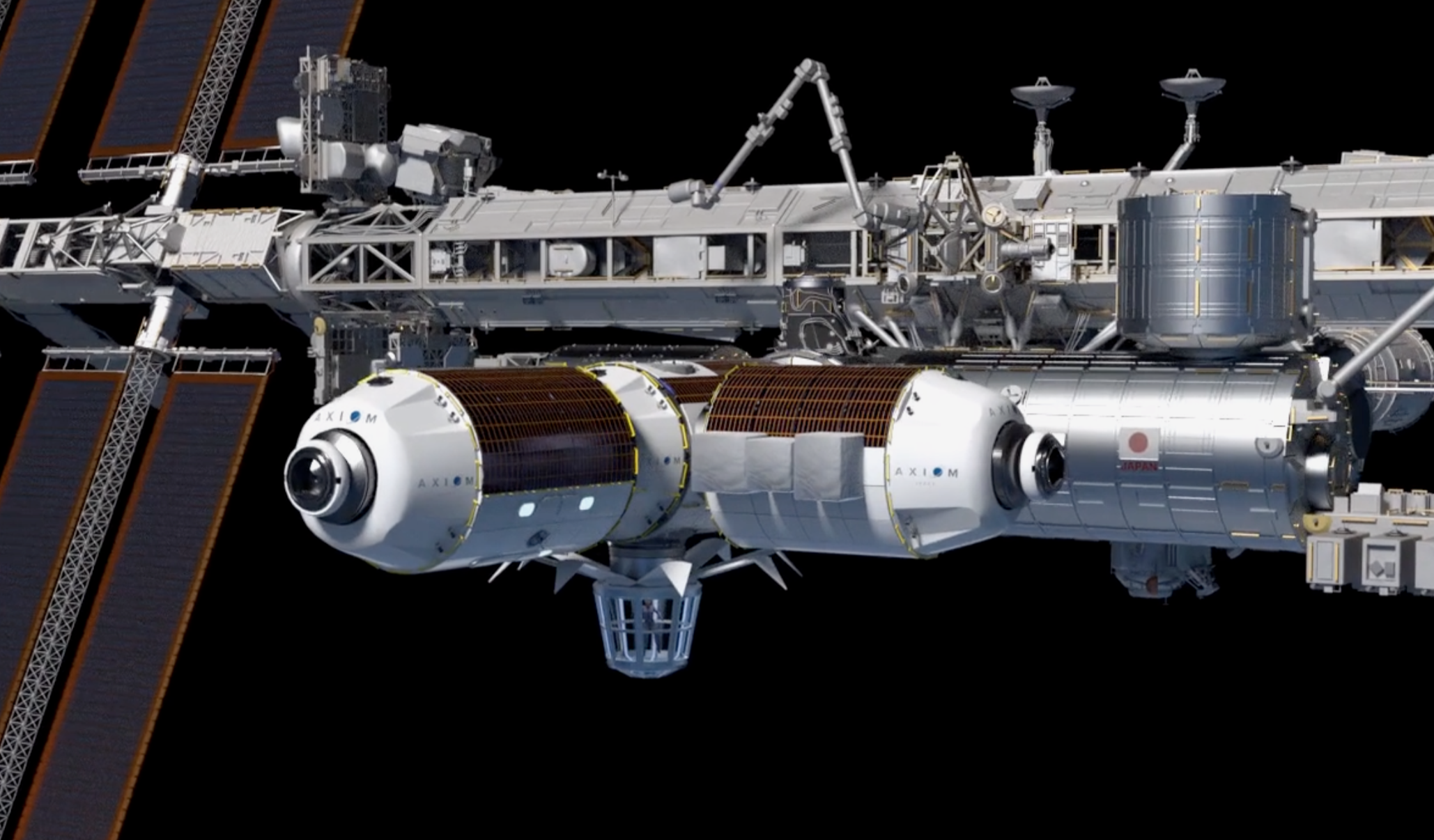

Russian officials believe there is another crack in its segment of the International Space Station.

Rocket Lab launched a secretive communications satellite for OHB Group early Wednesday.

In the latest in a series of acquisitions, Redwire has purchased Oakman Aerospace

Chinese launch startup iSpace is preparing for an initial public offering (IPO) of stock

SpaceX quietly purchased two oil rigs to convert into floating launch platforms

A Google-backed venture to provide wireless communications using balloons is shutting down